All instinctive behavior concerns survival: feeding, mating, fighting or fleeing. Strong emotions focus and lock our attention ...everything is simplified to a black-or-white choice. It is either safe or it isn't. The amygdala (the primitive mamallian brain in all humans) is so powerful that it can shut off the neo-cortex (higher intelligence) completely. High emotional arousal makes us temporarily stupid.

Most situations we deal with today are not life-and-death situations, which the amygdala is designed to operate under. If a car comes crashing toward us, it is the amygdala that propels us in to darting sideways and escaping injury. Thus, the role of the amygdala is survival. Once the life-threatening situation is averted, the feelings aroused out of fear are dealt with, the amygdala switches off.

Now, if the amygdala is operated under less than life-or-death situations, and the arousal is not dealt with, then the amygdala remains switched on, removing all access to higher intelligence. Thus, in a partially aroused state, we are partially stupid. Anxiety denies full access to the thinking brain.

Thursday, April 30, 2009

Anxiety

Posted by Bhoomi Trader at 9:24 PM 0 comments

Labels: AMYGDALA, ANXIETY, EMOTIONS, PSYCHOLOGY

Friday, April 24, 2009

Beta - Market Risk of a Stock

An important criteria when choosing what stock to trade is Beta. Sounds like Greek? Beta is indeed the second letter of the Greek alphabet, but, as a statistical tool, it holds great relevance in stock market investing.

Simply put, beta is a statistical tool that quantifies the degree of correlation of a stock to a benchmark share index, like the NSE Nifty or BSE Sensex. In other words, it measures the market risk of a stock.

A stock index is said to have a beta of 1, and stocks are measured against it. A stock with a beta greater than 1 is said to be more volatile than the market. So, for every 10 percent fall (or rise) in the Nifty, a stock with a beta of 1.5 will generally fall (or rise) 15 percent.

On the other hand, a stock with a beta of less than 1 is said to be less volatile than the market. So, for every 10 percent fall (or rise) in the Sensex, a stock with a beta of 0.5 will generally fall (or rise) 5 percent. In other words, the higher a stock’s beta, the more it is likely to fluctuate higher than the broader market.

Risk is an important consideration in holding any portfolio. The risk in holding securities is generally associated with the possibility that realized returns will be less than the returns expected.

Risks can be classified as Systematic risks and Unsystematic risks.

- Unsystematic risks:

These are risks that are unique to a firm or industry. Factors such as management capability, consumer preferences, labor, etc contribute to unsystematic risks. Unsystematic risks are controllable by nature and can be considerably reduced by sufficiently diversifying one's portfolio. - Systematic risks:

These are risks associated with the economic, political, sociological and other macro-level changes. They affect the entire market as a whole and cannot be controlled or eliminated merely by diversifying one's portfolio.

Beta is calculated as :

where,

Y is the returns on your portfolio or stock - DEPENDENT VARIABLE

X is the market returns or index - INDEPENDENT VARIABLE

Variance is the square of standard deviation.

Covariance is a statistic that measures how two variables co-vary, and is given by:

Where, N denotes the total number of observations, and

and

and  respectively represent the arithmetic averages of x and y.

respectively represent the arithmetic averages of x and y.In order to calculate the beta of a portfolio, multiply the weightage of each stock in the portfolio with its beta value to arrive at the weighted average beta of the portfolio.

Standard Deviation

Standard Deviation is a statistical tool, which measures the variability of returns from the expected value, or volatility. It is denoted by sigma(s) . It is calculated using the formula mentioned below:

Where,

is the sample mean, xi’s are the observations (returns), and N is the total number of observations or the sample size.

is the sample mean, xi’s are the observations (returns), and N is the total number of observations or the sample size.Beta is an indicator of a stock’s historical volatility. There’s no saying that the stock will show identical volatility in the future too. Having said that, most actively-traded stocks tend to do justice to their beta values.

Read the entire article here and here

Saturday, March 21, 2009

Gaps!!!

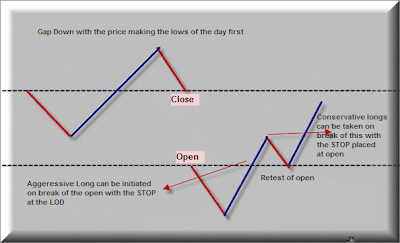

These are just a few examples of gaps and how we can play these gaps. The charts below are self explanatory. These are not exactly how the gaps would play themselves out, but would give you an idea, if such a situation occurs then these might be the possibilities. This is in keeping with the theory of KISS. By the way the conservative trades mentioned in the pictures below are nothing but the Dow Theory in action!!!!

First The Gap Ups;

Now The Gap Downs;

"If you are aware of your weaknesses and are constantly learning, your potential is virtually limitless." Jay Sidhu

Posted by Tryin2Trade at 8:20 PM 0 comments

Labels: Gaps, MANOJ BHAGRA, Technical Analysis

Trend Following ! Simpler The Better!!!

Today I had a nice discussion with a few friends and it all veered down to identifying the trend and its reversal. Well we discussed everything from trend lines, moving averages, to indicators and oscillators. Everyone had their own personal choices; like I always say different strokes for different folks! I personally find the good old Dow Theory the best for this. The good old higher highs and higher lows or the lower highs and lower lows sequence the best way to identify the trends. It sounds too simple but then I guess in TA simpler is what works! The element of KISS rulez!!! Please do take a look at the chart below and try to see if watching this action makes a difference to your trading. What I am talking about? Just look at the chart below and maybe you can see your MONA LISA!!!

Chart courtesy of Trading Strategies.

"I am great believer in luck and I find that the harder I work the more I have of it."

Thomas Jefferson

Posted by Tryin2Trade at 8:15 PM 0 comments

Labels: MANOJ BHAGRA, Technical Analysis, Trend

A Guru Or A Mentor???

This post got me into a bit of thinking (gray cells put to work!). I am not sure weather I will be able to express myself clearly, nevertheless I will give it a shot. When I started of two years back on this treacherous road to trading, I was desperately looking for helping hands that would pull me out from the precipice I had fallen into. There were a few hands (the world is still a good place to be in!). What I found later was that among these hands there were some who genuinely extended support (what ever knowledge they could offer they did…God bless them). Yet the other variety wanted me to keep on holding to their hand (they wanted to me to subscribe to their newsletters and call services …the prize??? they promised The Garden Of Eden!!!).

There were a whole lot of Gurus that came by, and very few Mentors. A lil bit of thinking got me to this conclusion. You see Gurus seek Disciples (meek) and Mentors seek Character (leaders). A guru needs these disciples, and they need them in hoards (this is provided by flush of new uninformed entrants to the market everyday). In the case of a Mentor, it’s the other way around. He shuns the hoards, and seeks out a few pieces of uncut rough rocks. A Guru will always give you sermons on what’s wrong with your life whereas the Mentor will show you how to put your life right. A guru will provide you with a sense of calm (his services, which he makes sure that you cant do without). A Mentor on the other hand will take away your calm make you sweat and toil. A Guru will never let you leave him (you are his milking cow!!!). A Mentor will not let you to stick to him (he has made a gem out of that rough uncut rock… his work done…and now he goes ahead to seek more such rough rocks).

The road to successful trading is not a smooth one. The treacherous journey has consumed many a souls. It’s long and a tiring journey and many of us give up mid way and seek solace in the arms of a Guru. What we need is a Mentor who teaches us to conquer the road ahead.

Don’t give up… see what lays ahead!!!!!!

The choice is yours… you need a Guru or a Mentor??? While you still ponder on, I suggest you read what Alexander Elder has to say about Gurus here. As for me.., I will be tryin2find a mentor!!!

Posted by Tryin2Trade at 8:02 PM 0 comments

Labels: MANOJ BHAGRA, Ramblings

Friday, March 20, 2009

Divergence - Manoj Bhagra

DIVERGENCE is a favorite trade setup of many traders. As Pring states, when the momentum and price are moving in tandem, there isn’t much to read other than assuming we have a healthy trend. It is when the momentum and price get out of sync that we have a divergence in hand.

There are 2 basic types of Divergence.

Regular Divergence

1-Price is making higher highs while the indicator is not: Bearish

2-Price is making lower lows while the indicator is not: Bullish

Hidden/Reverse Divergence

3-Indicator is making higher highs while price is not: Bearish

4-Indicator is making lower lows while the price is not: Bullish

Divergences test patience; one has to let them develop and then get ready to put in a trade. One of the mistakes novices make is to jump the gun too soon when a divergence is spotted. It should be remembered that divergences in themselves do not signify a reversal or a trend change; they merely gives us an advanced warning of the underlying strength or weakness in the prevalent trend. The real confirmation comes from the Price action itself.

There is a lot one needs to understand about divergence than these simple interpretations. The significance of Divergence, the Divergence Trap and Complex Divergence (will add these later). I reiterate again that one should read Pring’s book on Momentum to get better hang of things. Divergences if traded right, can give phenomenal trades, but then you need to spot them, and wait patiently to let them develop, and finally pull the trigger when the price gives the signal!

Posted by Bhoomi Trader at 7:40 AM 1 comments

Labels: DIVERGENCE, MANOJ BHAGRA

Sunday, March 15, 2009

Rogue Trader (1999) - The Movie

This movie is a must for all traders. It's basic message is this: no matter who you are and no matter how much you know, do not f**k with the market. Another key view that comes across is that it is erroneous to assume that the big institutions know everything. Of course, in the face of the 2008 subprime and financial crisis, this message may not have as much impact, but in 1999, when this movie was released, it would have been apt. Although we have moved on to bigger cycles, for those who are starting out as traders, this is a must-watch movie.

This movie is a must for all traders. It's basic message is this: no matter who you are and no matter how much you know, do not f**k with the market. Another key view that comes across is that it is erroneous to assume that the big institutions know everything. Of course, in the face of the 2008 subprime and financial crisis, this message may not have as much impact, but in 1999, when this movie was released, it would have been apt. Although we have moved on to bigger cycles, for those who are starting out as traders, this is a must-watch movie.

Rogue Trader is a 1999 drama film directed by James Dearden about Nick Leeson and the 1995 collapse of Barings Bank. Based on Leeson's book of the same name it stars Ewan McGregor and Anna Friel.

Rogue Trader tells the true story of Nick Leeson, an employee of Barings Bank who after a successful spell working for the firm's office in Indonesia is sent to Singapore as General Manager of the Trading Floor on the SIMEX exchange. The movie follows Leeson's rise as he soon becomes one of Barings' key traders. However, everything isn't as it appears - through the 88888 error account, Nick is hiding huge losses as he gambles away Baring's money with little more than the bat of an eyelid from the powers-that-be back in London.

Eventually the losses mount up to well over £800 million and Nick, along with his wife Lisa, decide to leave Singapore and escape to Indonesia. Nick doesn't realise the severity of his losses until he reads in the newspaper that Barings has gone bankrupt. They then decide to return to London but Nick is arrested en route in Frankfurt. Nick is extradited to Singapore where he is sentenced to six and a half years in jail (but stays in jail for four years, because he was diagnosed with colon cancer). The film is based on Leeson's real life book, Rogue Trader.

Download the torrent here.

Posted by Bhoomi Trader at 10:41 AM 0 comments

Labels: BUST, ROGUE TRADER, TRADING

Thursday, March 12, 2009

Boiler Room (2000) - The Movie - Must-see for Traders

This is a must-see movie for all those stepping in to the world of trading and investing or dealing with a relationship manager at a broker firm. This movie will open your eyes so wide that you will never ever keep your eyes closed when talking to a representative of a broking firm.

This is a must-see movie for all those stepping in to the world of trading and investing or dealing with a relationship manager at a broker firm. This movie will open your eyes so wide that you will never ever keep your eyes closed when talking to a representative of a broking firm.

It proves why trusting brokers, for stock tips and trades is the biggest risk one can take in the business. You can trade without technical analysis and still succeed but trusting a broker is the highest form of risk ever. As a senior writer with a leading analyst house said: All brokers around the world are boiler rooms.

The term boiler room in business refers to a centre of criminal activity where financial products, particularly stock, are sold by telephone. The targets of organisations using boiler rooms are often subject to unfair, pressured, and dishonest sales tactics. Whilst some boiler rooms specialise in stock fraud, most sell penny stock or shares in companies which have yet to float on a stock exchange, misrepresenting it as more valuable than it actually is.

Boiler Room is a 2000 US drama, written and directed by Ben Younger, and starring Giovanni Ribisi, Vin Diesel and Nia Long. Other characters in the film were played by Ben Affleck, Nicky Katt, Scott Caan, Tom Everett Scott (who also starred in That Thing You Do! with Ribisi), Ron Rifkin and Jamie Kennedy.

The film takes a look at the world of "boiler room" (seedy, dishonorable, and often fraudulent) brokerage firms. The film centers around college dropout Seth Davis (Ribisi), a budding underground casino owner from Queens, New York who gets a job at J.T. Marlin, a less-than-reputable brokerage firm. However at the time, Seth is totally unaware of the firm's criminal reputation. Davis' opposition to his disapproving federal judge father drives the plot as Davis goes deeper into the operation at J.T. Marlin than he'd like, learning how the firm scams its clients. The company is a chop shop brokerage firm that runs a "pump and dump", using its brokers to create artificial demand in the stock of defunct companies by cold calling investors and selling them shares at prices set by the brokerage firm, which include a large commission to the brokers (up to three dollars a share for a penny stock). When the firm is done pumping the stock, the investors then have no one to sell their shares to in the market, and the price of the stock plummets. As Seth learns more about the firm, he realizes he needs to get out. When the FBI confronts him, he agrees to help them bring down the firm. Although he feels bad about the many affluent investors (whales) that he lied to and scammed, he only tries to help one client who could not afford to be scammed in the first place.

Get the torrent here

Posted by Bhoomi Trader at 10:34 PM 0 comments

Labels: BOILER ROOM, MOVIE, TRADING

Tuesday, March 10, 2009

Street Smarts - Linda Rashke

Traders talk amongst themselves, not necessarily to discuss bullish or bearish market opinions, but rather to share insights into the nature and quirkiness of this business.

The mental toll trading exacts definitely forms bonds. When we open up it is always surprising to discover the similarity of lessons learned, experiences shared, and how we all independently arrive at the same conclusions. Often in talking with each other we're really looking for clues into our own heads, hoping to understand ourselves a little better.

Despite our constant pursuit of knowledge, the market itself assures there is no shortcut to obtaining our final degree. In the end, it is experience which is our ultimate teacher and there is no substitute. We can only choose the attitude with which we approach this process of learning to trade. We can accept the inevitable setbacks and learn from them, or we can yield to our natural human stubbornness and be forced to repeat the same lessons over and over again. The single most important secret is this: learn to listen to the markets and do not impose your own will upon them.

Every successful trader we have known has also discovered the necessity for consistency. It is the key to everything - you must trade with a coherent methodology. You must follow a specific trading strategy. The essential starting point is: minimizing risk first, looking to maximize gains only after risk has been defined and controlled. Our number one guiding belief is that you must, above all, find setups and entries which minimize exposure. The profits come on their own terms.

You only need ONE strategy to be prosperous. Some of the best traders are successful because they trade only one strategy.

Posted by Bhoomi Trader at 2:00 PM 0 comments

Labels: LINDA RASHKE, TRADING